My money’s on Datana  Otherwise, @clang has the speed advantage while @borstein wins on height

Otherwise, @clang has the speed advantage while @borstein wins on height

These exchanges have made me realize just how much I miss talking to all you nerds.

LOL. you totally did it right… and regarding who would win in a fight it depends… I’d love to see someone build robot models and analyze the data, like they do in Nat Geo. The difference is probably some obscure Lang trait, like when the Lion won vs the Tiger because the tiger’s jaws could get a clean grip on the lion because it’s mane got in the way. Spoiler: tiger is bigger and stronger but lion wins!

OMG… I have so many thoughts / rants.

OMG… I have so many thoughts / rants.  I’m going to answer conceptually AND concretely.

I’m going to answer conceptually AND concretely.

- In legal buy, we try to swap the mutual trust required for stable institutional relationships function with stuff that intrinsically ERODES trust (increasingly granular contractual obligations followed by increasingly invasive administrative monitoring + enforcement). Clients do this to outside firms, and firms are doing this to partners, fee earners and staff. This is going in the wrong direction.

- We confuse “more expedient for me now” with “better for everyone forever” without regard to second- and third-order impacts and unintended harm.

- We bolt on new requirements, processes, tech, programs, initiatives, and priorities without rationalizing/refactoring what exists.

Examples of how this manifests.

Convergence and volume discounts.

-

It’s true clients would benefit from a rationalized legal supply chain of fewer providers overall. But first-gen (and many current-gen) efforts are geared at exactly that without too much rigor on optimal coverage. One-stop (or fewer-stop) shopping for #legal services I think has created skewed incentive for law firms to seek safety in size and breadth. As a result many law firms now have expanded geographic footprint, practice lineup, and industry coverage. Also, many law firms now say (in their marketing) that they do everything for everyone. This is… bad for clients because that means that now more law firms are doing stuff that they’re not great at.

-

As against that backdrop, volume discounts are bad for both clients and firms. The current year spend reduction might be expedient for some individuals on the client side who need to hit those targets. But they’re bad for optimizing the effectiveness and the performance of the supplier network. They create adverse incentives for in-house counsel who are economic buyers to choose suboptimal providers. They create adverse incentives for law firms to continue diffusing their focus in areas where they’re not disadvantaged. This creates more noise in the market and makes credence goods harder to buy.

Outside counsel guidelines. These are getting more complicated, stringent and granular; and often written in a way that enables clients to unilaterally impose punitive measures / consequences for non-compliance. They’re also fragmented across the market because so many clients customize how administrative tasks need to be done (tech can help here, but this is a problem that doesn’t need to exist or be so bad). In practice, this lets clients impose additional discounts as penalties without a forcing function for any conversation with suppliers. This is bad for firms bc of immediate revenue leakage, but it’s bad for both clients and firms because it exponentially explodes administrative burden on both sides. Instead of picking up the phone, voicing concerns about a matter and asking for an adjustment off the invoice, billing guidelines basically generate up to 100 adjustments at the time entry level for (a) someone at the supplier to review and maybe contest; (b) someone at the client to review appeals and respond. This is not a functional way for large scale institutions to transact business. Basically, we are grafting digitalization to the billing process without appropriate refactoring of what existed before: time as atomic unit of value and time entry descriptors of that value written by humans for humans to read. For e-billing to really deliver on its potential, we need to rethink AT MINIMUM how providers can generate time entries (combining human effort + tech) that computers can read/process.

I could go on forever but these are top of mind.

Bad analogy. Did they ever model common chicken v. T-Rex?

Loooove this ^. So true.

I’d argue the problem is more fundamental; many existing organizations - like law firms and legal depts - don’t have much by way of strategic direction. Without it they are challenged to rationalize / refactor.

And that lion is the one in your prof pic.

I’m a tiger guy, even if they are losers.

He’s actually alive but if you can’t see it then that means that your all grown up… and I think he’s imported from somewhere in the far east because Watterson didn’t allow official merch

I’m personally more curious about the Klein-Stroka undercard

OMG I love this question bc it asks what the practical implications of high-risk/high-reward strategy might be in time to ROI and size of the prize.

OMG I love this question bc it asks what the practical implications of high-risk/high-reward strategy might be in time to ROI and size of the prize.

Competition occurs in context so I’ll answer by segment.

Competition occurs in context so I’ll answer by segment.

For incumbent law firms this is a really difficult endeavor overall. Current position isn’t destiny but the current state does create both opportunities and constraints. Really hard questions for firms to ask and answer in the current data environment… (a) how diffuse is the current industry focus across the installed client base & (b) how revenue-dependent is each firm in industries that might be non-core in future and might need shedding? For some firms, shifting the locus of strategic planning from location and practice to client industries will be really hard. Physical location is where major capex like real estate is managed; law is a people business so it makes sense for the firm to think in a firm-centric way about practice-led approaches. Talent is both the big-ticket cost line as well as where critical strategic investments are made.

For incumbent law firms this is a really difficult endeavor overall. Current position isn’t destiny but the current state does create both opportunities and constraints. Really hard questions for firms to ask and answer in the current data environment… (a) how diffuse is the current industry focus across the installed client base & (b) how revenue-dependent is each firm in industries that might be non-core in future and might need shedding? For some firms, shifting the locus of strategic planning from location and practice to client industries will be really hard. Physical location is where major capex like real estate is managed; law is a people business so it makes sense for the firm to think in a firm-centric way about practice-led approaches. Talent is both the big-ticket cost line as well as where critical strategic investments are made.

So… it is a long bake for law firms – longer for some than others. I think the McKinsey horizons are a good place to start when thinking about timeframe for strategic planning: horizon 1 being the next 12-24 months; horizon 2 being the 2 to 5 year period; horizon 3 being 5 to 10 years.

So… it is a long bake for law firms – longer for some than others. I think the McKinsey horizons are a good place to start when thinking about timeframe for strategic planning: horizon 1 being the next 12-24 months; horizon 2 being the 2 to 5 year period; horizon 3 being 5 to 10 years.

For law firms, also consider that meaningfully rebalancing the industry mix in client base will usually require both shedding and investing. This means asking and at least generating testable hypotheses on  hard questions cited above to rationalize the client base. But it also usually means acquiring your way into client segments by sector, which will mean lateral hires. Because a 3-year guarantee is pretty typical for marquee lateral hires and lateral onboarding takes about 6-12 months, the second horizing (2-5 years) sounds right to me for this type of GTM to fully bear fruit.

hard questions cited above to rationalize the client base. But it also usually means acquiring your way into client segments by sector, which will mean lateral hires. Because a 3-year guarantee is pretty typical for marquee lateral hires and lateral onboarding takes about 6-12 months, the second horizing (2-5 years) sounds right to me for this type of GTM to fully bear fruit.

For relatively newer entrants like ALSPs, the time to value for industry-focused GTM will be much, much, much faster. They are smaller and can make growth bets without a brain-scrambling exercise on how forward-looking strategy overlays onto the current client and service line portfolio. I’d say 12 months.

For relatively newer entrants like ALSPs, the time to value for industry-focused GTM will be much, much, much faster. They are smaller and can make growth bets without a brain-scrambling exercise on how forward-looking strategy overlays onto the current client and service line portfolio. I’d say 12 months.

The answer for Big 4 is less clear. They have some of the advantages of ALSPs… but they inherit a ton of similar strategy diffusion from globally yuge service and business lines across tax, audit and advisory. Last I checked, Big 4 collective audit all but 1 of the Fortune 500 and audit independence is an impenetrable conflicts barrier. The same relationship / turf dynamics that plague large law firms apply to Big 4 advisory businesses and will likely apply in equal or greater force to their foray into legal. If any one of the Big 4 threads this needle optimally I still think GTM horizon is 2-5 years.

The answer for Big 4 is less clear. They have some of the advantages of ALSPs… but they inherit a ton of similar strategy diffusion from globally yuge service and business lines across tax, audit and advisory. Last I checked, Big 4 collective audit all but 1 of the Fortune 500 and audit independence is an impenetrable conflicts barrier. The same relationship / turf dynamics that plague large law firms apply to Big 4 advisory businesses and will likely apply in equal or greater force to their foray into legal. If any one of the Big 4 threads this needle optimally I still think GTM horizon is 2-5 years.

As to permanence/transience of the underlying performance dispersion… this is probably shifting toward shorter cycles (e.g. getting more transient). BUT for the firms that REALLY, REALLY nail industry focus, the financial rewards are vast and the competitive advantages are actually very durable, although ongoing stewardship + strategy refreshes will be needed.

As to permanence/transience of the underlying performance dispersion… this is probably shifting toward shorter cycles (e.g. getting more transient). BUT for the firms that REALLY, REALLY nail industry focus, the financial rewards are vast and the competitive advantages are actually very durable, although ongoing stewardship + strategy refreshes will be needed.

There’s many reasons that Big Banks are increasingly a tough (read: margin challenged) client segment for the vast majority of law firms to serve, even fairly prestige providers in the global bracket and even some of the old-line banking firms in NY and London. BUT Davis Polk has discharged existentially important mandates for JP Morgan since JP Morgan was a rich dude  and not a global financial conglomerate

and not a global financial conglomerate  .

.

More and more, Big Business in the most intensely regulated sectors are pursuing bifurcated buying strategies: paying $$$$ premium for bet-the-company work to an ever-smaller set of providers and imposing “draconian” rate pressure (a direct quote from a Dechert partner) on everyone else for everything else. So firms hoping to compete effectively and protect margins in Big Pharma, Big Oil & Gas, and increasingly Big Tech are going to have to invest heavily in industry-specific expertise to compete for the $$$$ premium work.

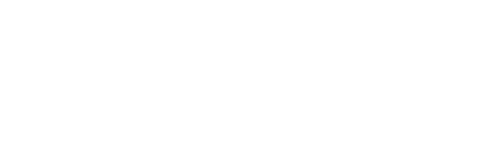

Existentially though, the shift to industry focus hints at an important shift in management ethos: being demand-led (e.g. client-centric and market-oriented) rather than supply-driven (e.g. lawyer-centric and firm-oriented). This is really, really, really, really hard but it has lots of strategic implications on brand + pricing position.

Existentially though, the shift to industry focus hints at an important shift in management ethos: being demand-led (e.g. client-centric and market-oriented) rather than supply-driven (e.g. lawyer-centric and firm-oriented). This is really, really, really, really hard but it has lots of strategic implications on brand + pricing position.

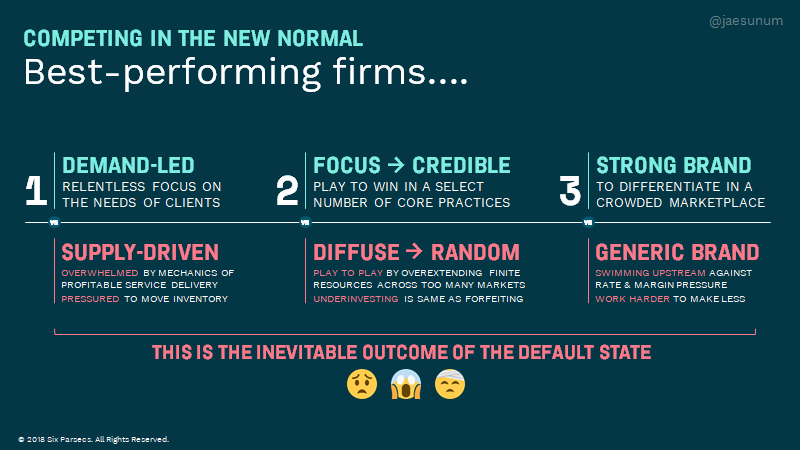

in the K-shaped analysis separating “resilient” firms from “everyone else,” probably the most explanatory difference is that resilient firms are demand-led rather than supply driven. This is also from Part 2.

in the K-shaped analysis separating “resilient” firms from “everyone else,” probably the most explanatory difference is that resilient firms are demand-led rather than supply driven. This is also from Part 2.

In short… demand-led GTM strategies take time to play out, are higher-risk/higher-reward strategies than legacy practices of most of the enterprise law market… but the rewards for the winners bigly yuge.

Really excellent question but deserves more context-specific answers than are possible here. Will do my best to generalize.

In some tranches of flow-oriented (rather than episodic) legal demand, subscription models can work. I think these fall into two buckets, but each requires new thinking about service definition that is pretty difficult for both clients and firms.

-

Unit packaging for frequently recurring work that fall generally within a predictable range of scope and complexity

-

Bundling of amorphous low complexity work where the transaction costs of engagement don’t merit the business value at stake for either client or firm

BUT subscription doesn’t work economically for providers UNLESS clients are willing to buy cost predictability by providing revenue predictability for firms. Put differently, subscription pricing has to be a two-way street. A $10k monthly retainer to cover xyz types of counseling questions have to result in $10k per month to the firm. Often, clients ask for subscription pricing when what they are actually expecting is capped arrangements.

This goes back to trust erosion across buyer and providers and how that is feeding a continuing erosion in commercial rationality underlying legal buy. Reciprocity is a natural law and one-sided fee arrangements just aren’t sustainable (regardless of how “innovative” they are).

I’d point out here that law firms take financial risk every year in working capital outlays. Clients are (I hope unintentionally) putting more pressure on that risk profile through many AFA types that don’t make commercial or financial sense for the firm, often on vague promises of access to future work and goodwill to support the relationship. As an intermittent relationship tool, this is OK. But when it comes to the future of specific pricing models and their likelihood to proliferate across the industry – I don’t think subscription pricing is top-of-mind for institutional clients of large clients for higher complexity work.

Subscription pricing does have immense promise for more digitalized, content+ offerings that utilize expert systems – across all segments of the legal market. But this requires incumbent firms to engage in business model innovation to make sure that these revenue models for non-core offerings can play nicely with the high-margin business lines that support the business today.

Nice discussion of BMC here and some of the change management barriers from Josh Kubicki here…

This makes me realize I didn’t address the last layer in James’s original question about bringing tech + services directly to market to corporates and competing with firms.

YES. I STRONGLY believe #legaltech should consider displacement plays. Corporates comprise a much larger TAM (and often larger SAM – serviceable addressable market – relative to selling ONLY to law firms).

Thank you for reading and for your kind comments always.

Thank you for reading and for your kind comments always.

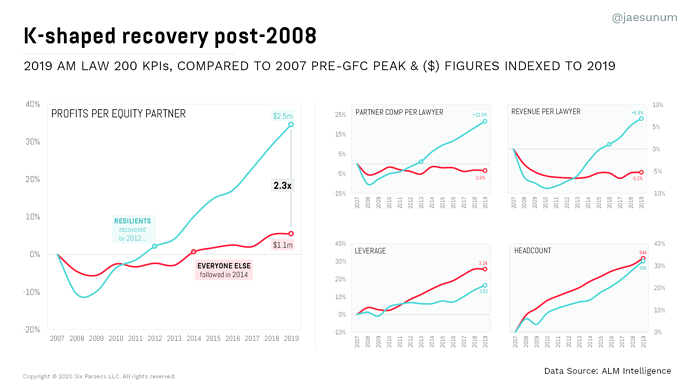

I don’t think I’m the best qualified person to comment on the regulatory moat beyond saying I think the developments in the enterprise market over the past 15-20 years show that regulatory environment doesn’t actually prevent evolution / innovation. In the RETAIL market (L2C in Bill Henderson’s graphic above) I think individual consumers of legal services probably need more protection than corporate buyers but we still need to find ways to leverage digital transformation to expand access to legal services.

ALM has been an amazing partner and resource. Through the ALM Intelligence Fellows program I have access to their research which helps with the longitudinal analysis.

BUT much of the “data” in the legal vertical is limited to self-reported / survey data and/or secondary desk research (e.g. studies conducted by others). For these, Thomson Reuters LEI publishes a lot from Peer Monitor; Acritas does as well now under the TR umbrella; Citi-Hildebrandt Client Advisory and TR-Georgetown State of the Industry reports annually; Blickstein Group Law Dept Operations Survey; Legal Value Network just released a new report with Blickstein Group covering results of Legal Pricing and Project Mgmt survey, which I hope they’ll continue.

RAW data sources are hard to come by in our industry. I try to anchor analyses to macroeconomic data sets, some of which are public: FRED, BEA, Census data. For startup data I try to cross-reference Crunchbase with AngelList and now other new resources like Legal Tech Hub, but this takes a LOT of handpainting.

(FYI… one of the things Datana will do is make it MUCH easier to blend these external data sets with internal data for analysis. I AM SO EXCITED because I have spent hours and hours nad hours of my life doing this data wrangling.  @robsaccone please go back to coding so we can all have this faster…

@robsaccone please go back to coding so we can all have this faster…  )

)

Will come back and add links later but going to try to get to one or two more Qs!

So these are loaded questions.

I think more firms are moving in the direction of injecting more business rigor in how they run their business. I would guess that any success I’ve had in driving positive change in the law firm environment is by respecting the governance model specific to each law firm. The owners of the business retain ultimate decision-making authority; serving an effective executive in that environment means accepting some limitation to authority and functioning as an advisor in decision-making and in executing on plan (on budget + on time) after decisions are made.

I think more firms are moving in the direction of injecting more business rigor in how they run their business. I would guess that any success I’ve had in driving positive change in the law firm environment is by respecting the governance model specific to each law firm. The owners of the business retain ultimate decision-making authority; serving an effective executive in that environment means accepting some limitation to authority and functioning as an advisor in decision-making and in executing on plan (on budget + on time) after decisions are made.

Large law firms are extraordinarily complex businesses – domain expertise in the law and how it is developing is a key component. On that basis, I think it’s reductive to frame a power struggle between the equity partnership and the business executive cohort. Understanding evolution of legislative and regulatory environments is critical to ensuring ongoing vitality of the core service lines. Patrick McKenna has a great framework on this which he calls Type 0 innovation – read more about it here.

I think the sort of behavior we want to see from law firms has more to do with HOW they decide rather than WHO within the firm makes each decision. A data-informed approach that can synthesize insights across both legal and business domains will win.

I’ll save you a couple seconds and share my own links:

13th Annual LDO Survey: LDO Survey – Blickstein Group

(New) Legal Pricing & Project Management Survey: LPPM Survey – Blickstein Group

Saved the hardest questions for last

Saved the hardest questions for last

I  all my startups equally…

all my startups equally…

Why LexFusion and RC? Because they’re new types of intermediaries rethinking old paradigms and both of them will “grease the gears of legal commerce” to modernize legal practice and business.

Why Datana? I said 6x in this AMA but because we need a new set of creator/builder tools to make modern analytics and decision science a reality.

(Why LegalMation? Because they’re rethinking how human+machine can free litigators from drudgery and create win-wins across clients and firms).

I pick Lang over Borstein in a fight (because I say so but maybe bc Lang organized this AMA and Borstein doesn’t follow instructions… Joe is taller though)

I pick Lang over Borstein in a fight (because I say so but maybe bc Lang organized this AMA and Borstein doesn’t follow instructions… Joe is taller though)

Bonus answer bc this Q is so important. Without too much context:

- Think intentionally about performance incentives for the in-house counsel who comprise the economic buyer group, not just about incentivizing the outside supply chain.

- Focus on expanding sphere of influence internally within the enterprise – upward to C-suite and board, outward to the business, across the buyer cohort of in-house counsel.

- Tell firms what you want to achieve, not how you want them to do work. Ask your firms what would help them deliver what you want. I promise firms want to please clients.

Thank you for being open to this viewpoint. You are a

Thank you for being open to this viewpoint. You are a  .

.